I wanted to provide a little update from when we started (August 2013) to now (December 2014/January 2015) We’ve come a long way, but we’ve also made some mistakes. What we’ve found to be 100% true, though, is that frugality is hard for materialistic people like us, and that sticking to the budget will never come easy. It is a struggle every single month. However, the end result will be completely worth it!

…..aaaaaaand, here goes our balance sheet:

August 2013

December 2014/January 2015

Our net worth has actually gone down in 17 months, Crazy, right? Our home value has remained the same (I’m assuming, we haven’t actually gotten a new appraisal, but I try to keep an eye on home prices in our area), we bought a Traverse (and have a god-awful loan out on it), bought a used Pasat, and sold the Truck, Cruze, and Focus. Basically, we’re down to one car loan, so that’s exciting.

Overall, our savings have remained at about $1,000, a bare-bones emergency fund, but we’ll be slowly starting to build that up in 2015.

August 2013

December 2014

*****Progress has been slow. We made a couple mistakes (like purchasing a new car when I was 1 week postpartum. I’m going to blame the hormones, but that doesn’t make it suck less), but we also lowered our debt by $9,437.29….and our income is right around $36,000 a year after taxes.

I do need to add the $4,200 in credit card debt that we managed to dig ourselves back into due to a couple of unexpected medical bills, and a school bill. It sucks, but we’ve set an awesome, but SMART challenge for ourselves in 2015.

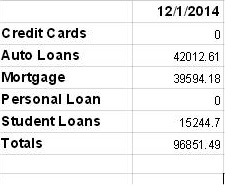

So what does our situation look like month-to-month? Here it is, folks:

August 2013

December 2014

Back in August 2013, there were so many things we were doing wrong.

#1, our income was higher. We were both working, but were unhappy. Now, we’re much happier on a smaller income, with the Big Guy being Mr. Mom. He loves it, I love it, it works. But it does make the budget tight. Over the course of 17 months we’ve managed to trim so many budget areas:

- Phone

- Groceries

- Pet Food

- Eating Out

- Hobbies

- And the Personal Loan payment

But, we’ve also stopped savings – although that will start up again in 2015.

While our net worth overall has decreased, we’ve improved our financial position so much, it is so encouraging! Sometimes, when you’re in the midst of a 3-4 year debt repayment journey, it can be hard to see the light at the end of the tunnel.

You wonder, how can I keep going like this, with a bare-bones budget, and killing ourselves to make an extra dime?

That’s where the value in looking back comes in. I had been feeling down about out finances, but after looking at this, I am so much more encourage, and excited for 2015! If you want to read more about our plan, check out this post!

How far have you come financially? How long did it take you? How did you motivated yourself?

*This post may contain affiliate links

Congratulations for the debt pay off….any penny that you can throw at deb is always good. Good luck with your financial journey during 2015.

Thanks Petrish – you too!

You are doing great, Gretchen – keep plugging along. We have found that, after two years now, that our urges to spend are nearly gone. It’s involved a lot of prayer, and a lot of searching our hearts for what we truly want (financial stability over stuff) but it’s nice to be totally okay with not spending, and you guys will get there too. Keep up the great work!

Wow – it’s good to know my materialistic urges will go away. We just have to keep going!

Truly inspiring. Your august looks like my now! I feel your struggles and im glad that someone shares mine.

Isn’t it nice to know someone else is having the same struggles? Not a haha nice, but an “i can sympathize with you” nice. Plus, then you can learn from them!

You are doing great! One thing I’ve been amazed at is how fast one’s net worth can grow! You have the recipe, now just cook the meal!

It is cool, isn’t it!

Way to go wiping out that personal loan! My car payment is about the same as yours. I love my car and will be thrilled when it’s paid off. Finances are like organizing. You get a few things organized and then have to go back to tidy up/readjust. I’m not sure we ever ‘arrive’ but we sure can enjoy the trip;0)

Thanks Jayleen! Yeah, that car payment is tough – and I love your perspective on finances. It’s totally true!